Choosing the right trade terms in international trade is crucial for both parties to ensure a smooth and successful transaction. Here are three factors to consider when choosing trade terms:

Risks: The level of risk that each party is willing to take on can help determine the appropriate trade term. For example, if the buyer wants to minimize their risk, they may prefer a term like FOB (Free On Board) where the seller takes responsibility for loading the goods onto the shipping vessel. If the seller wants to minimize their risk, they may prefer a term like CIF (Cost, Insurance, Freight) where the buyer takes responsibility for insuring the goods in transit.

Cost: The cost of transportation, insurance, and customs duties can vary widely depending on the trade term. It's important to consider who will be responsible for these costs and factor them into the overall price of the transaction. For example, if the seller agrees to pay for transportation and insurance, they may charge a higher price to cover those costs.

Logistics: The logistics of transporting the goods can also impact the choice of trade term. For example, if the goods are bulky or heavy, it may be more practical for the seller to arrange for transportation and loading. Alternatively, if the goods are perishable, the buyer may want to take responsibility for shipping to ensure that the goods arrive quickly and in good condition.

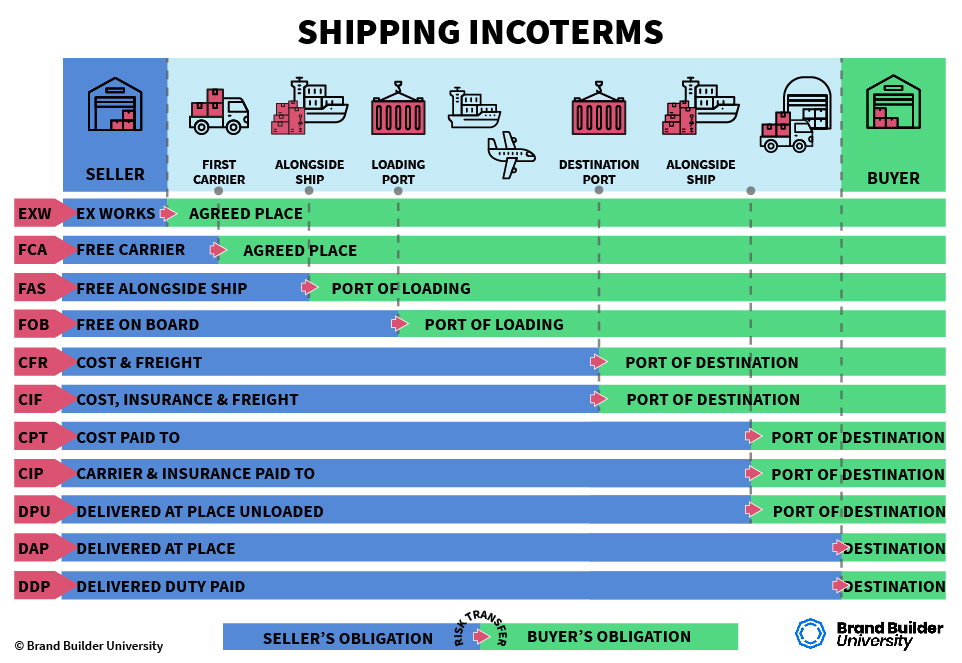

Some common trade terms include EXW (Ex Works), FCA (Free Carrier), FOB (Free On Board), CFR (Cost and Freight), CIF (Cost, Insurance, Freight), and DDP (Delivered Duty Paid). It's important to carefully review the terms of each trade option and agree upon them with the other party before finalizing the transaction.

EXW (Ex Works)

Description: Buyer bears all costs and risks involved in picking up the goods at the seller's factory or warehouse.

Difference: Seller only needs to have the goods ready for pickup, while buyer handles all other aspects of shipping, including customs clearance, transportation, and insurance.

Risk allocation: All risks transfer from seller to buyer.

FOB (Free on Board)

Description: Seller covers costs and risks of delivering goods onto the ship, while buyer assumes all costs and risks beyond that point.

Difference: The buyer takes responsibility for shipping costs, insurance, and customs clearance beyond loading onto the ship.

Risk allocation: Risk transfers from seller to buyer once the goods pass over the ship's rail.

CIF (Cost, Insurance and Freight)

Description: The seller is responsible for all costs associated with getting the goods to the port of destination, including freight and insurance, while the buyer is responsible for any costs incurred after the goods arrive at the port.

Difference: The seller handles shipping and insurance, while the buyer pays for customs duties and other fees upon arrival.

Risk allocation: Risk transfers from seller to buyer upon delivery of goods to the port of destination.

CFR (Cost and Freight)

Description: Seller pays for shipping, but not insurance or any costs incurred after arrival at port.

Difference: The buyer pays for insurance, customs duties and any fees incurred after arrival at port.

Risk allocation: Risk transfers from the seller to the buyer when the goods are on board the ship.

DDP (Delivered Duty Paid)

Description: The seller delivers the goods to a specified location, and is responsible for both costs and risks until they reach that location.

Difference: The buyer only needs to wait for the goods to arrive at the designated location without taking responsibility for any costs or risks.

Risk allocation: All risks and costs are borne by the seller.

DDU (Delivered Duty Unpaid)

Description: The seller delivers the goods to a specified location, but the buyer is responsible for any costs associated with importing the goods, such as customs duties and other fees.

Difference: The buyer bears the costs and risks associated with importing the goods.

Risk allocation: Most risks are transferred to the buyer upon delivery, except for the risk of non-payment.

Post time: Mar-11-2023